Tag: levels

-

Asian Session

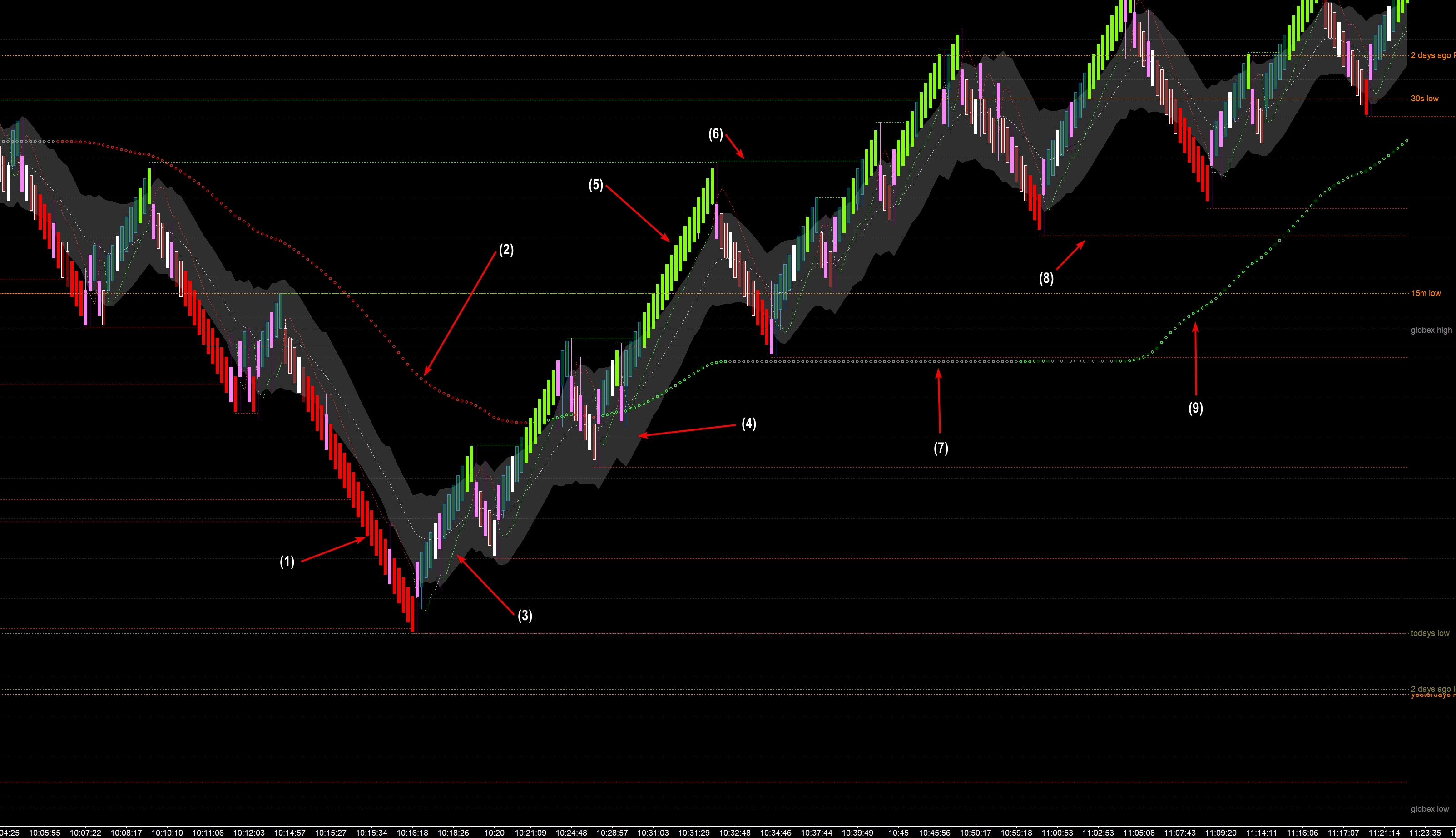

I have tweeked the Keltner settings to 45 periods. The reasoning is that it clearly shows price exiting and moving away from the channel during a strong trend move. Based on experience, I know that the more reliable trade is the pullback-continuation. In the case of this system, (1) wait for price to exit the…

-

The Matador V.22

I was told by my advisor in undergrad that if you really understand something you should be able to explain it so that everyone can understand. I was a chemistry major so he was basically telling me to explain concepts so that someone without a science background would be able to understand. This has always…

-

Just A Trade A Day

One of my favorite trading books is Michael Jardine’s “Just A Trade A Day”. While I do not use the exact techniques in this book, I think it provides a good foundation and if you can find that one good trade – you really just need a trade a day. Today was one of those…

-

Sierra Chart Risk Management

In my humble opinion Sierra Chart is the most powerful trading platform that offers a wide range of features for traders of all levels. One of the most important features of Sierra Chart is its server side risk management capabilities. These capabilities allow traders to set up rules that will automatically close their positions if…

-

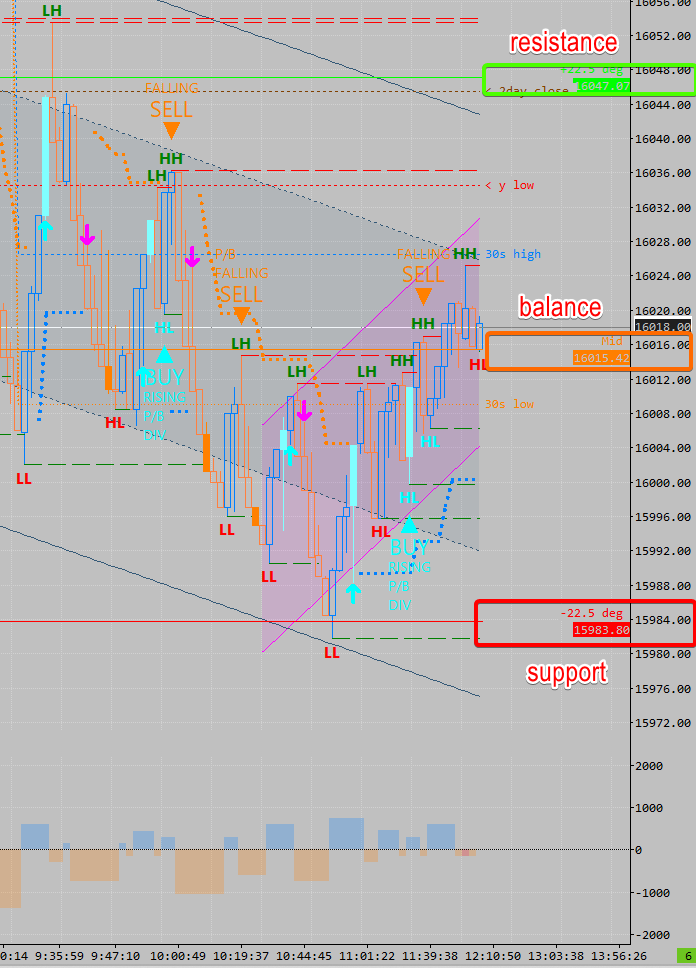

Overnight: Buyers Absorbed

The purple arrows (circled) are all indications that buyers are being absorbed. This is only a signal to buy if price is below the ATR stop (the purple dotted line). If I get an absorption signal on a pullback – I will enter at market as soon as the candle closes. I always enter with…

-

Added: Trading Glossary

Before I dive into what it is I do, I thought it best to create a glossary of all the terms. Most (not all) of the terms have links for more detailed explanations. Please utilize to familiarize yourself with the key concepts vital to the way I trade. As always, feel free to ask any…

-

Matador vs Bull: The Final Confrontation

The tense moment at the end of a bullfight when the matador stands facing the bull before he attempts to kill it has a specific name in Spanish – “la suerte suprema”. In English, this intense stare down is sometimes referred to as:

-

The Toss of a Coin: The Psychology Behind Trading Decisions

Flipping a coin seems like a completely random event – but is there actually more psychology involved than we realize? Interesting research has examined how humans behave when asked to predict coin tosses. The results reveal some fascinating insights that may apply to trading decisions as well. A classic study had participants guess if a…

-

Gann Square of 9

Let me start by saying I am not a Gann expert. I read an article about the accuracy of his predictions and my curious nature prompted me to add the Square of 9 (comes with Sierra Chart) to my charts. I am amazed at how price behaves at these levels. I do not trade them…