Since this is the first post in quite some time, I will go over what you are seeing on this chart.

First this is a December NQ Futures (NQZ3) 150 Delta Volume chart and it goes without saying that the platform is Sierra Chart.

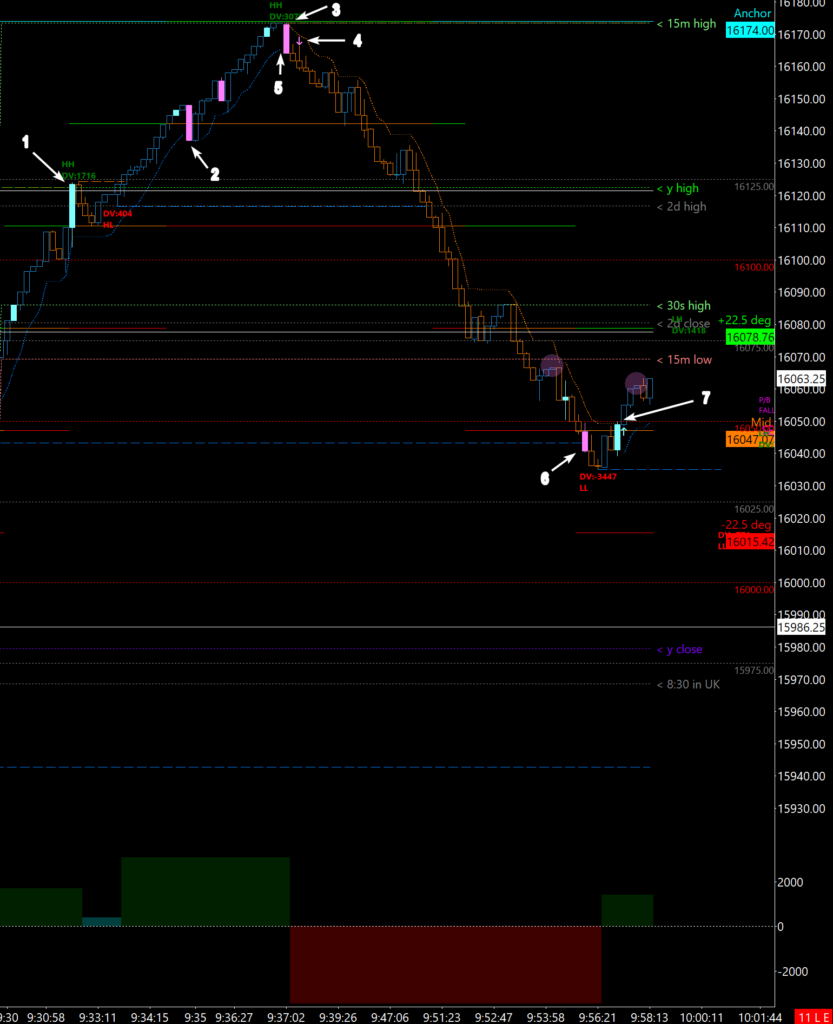

I have done some tweaking to Sierra’s alerts to get buy and sell signals (pink & cyan filled bars and arrows). The blue and orange dots trailing price are just the indicator “Kiwi’s Trailing Stop”. The dashed horizontal lines are swing high’s and lows. Dotted horizontal lines are what I call LOI’s (Levels of Interest), and are known levels from previous sessions. At the bottom is just swing delta volume which I use to estimate if the swings are getting weaker.

9:30 A.M.

Right from the jump this action was all bullish with price immediately leaving the 30 second range on the high side. If you followed my blog during covid you know I was all over 30 second breakouts and would have entered long on that very first cyan candle. Times have changed and I rarely play the 30 second breaks anymore, although they still look delicious.

First Entry

The second cyan bar (label 1) is the next signal and if you look at the swing delta below you also see a cyan delta which means the pullback was showing delta divergence. In this instance we got a nice swing entry point at 16124.25, being so close to a quarter level (00,25,50) I would just enter at 16125.00.

The sell signal – the large pink candle (label 2) stopped me out with a small profit. The next sell signal was ignored as it was on the wrong side of the trail and the delta volume was still strongly bullish.

second entry

The second entry was the trade of the day. In all honesty I botched the initial entry and was not filled. It starts with a nice bearish sell signal, the pink filled candle (label 3) which also breached Kiwi’s trailing stop (label 5) and giving a trend turn signal (label 4). When you get all three within a 4 or 5 bar sequence, I’m in. I should have entered on the close of the bar with the 3rd signal, but I missed it and waited for a pullback. Entered at 16152 and should have trailed down to 16050 (label 7), but I prematurely exited – even though I have automated the exits with Sierra.

Two trades was enough. Honestly I was surprised the market moved as much as it did during a holiday session.

As always, your questions and comments are welcomed!

Leave a Reply